TradGrip.com Reviews

TradGrip.com(TradGrip.com) have raised significant concerns among users due to unexpected issues with withdrawals, fees, and communication. One platform that has drawn increasing scrutiny is TradGrip.com.

A growing number of individuals are reporting problems such as delayed or blocked withdrawals, unexplained fee demands, account restrictions, and poor customer support — prompting searches for terms like “TradGrip.com scam.” This in-depth investigation examines the patterns of behavior reported by users, common warning signs, and recommended steps for individuals who believe they have lost funds or been misled.

TradGrip.com promotes itself as an online trading platform offering access to forex, CFDs, and other markets, along with advanced trading tools and support services. Promotional content often highlights ease of access, professional guidance, and quick execution. However, according to multiple user reports shared through forums, social media, and review sites, the actual experience may differ significantly once funds are deposited and withdrawal requests are made.

TradGrip.com Scam: What You Need to Know

Many users say they initially discover TradGrip.com through online ads, affiliate promotions, or recommendations from trading groups and communities. These promotions often emphasize attractive returns, tailored support, and minimal risk — language that can be particularly persuasive to new or inexperienced traders.

After depositing funds, some users report seeing apparent profits or positive activity on their dashboards, reinforcing confidence in the platform. Early engagement with assigned account managers often appears professional, encouraging traders to increase their deposits or explore higher account tiers. Unfortunately, according to multiple user accounts, issues often begin when traders attempt to make withdrawal requests.

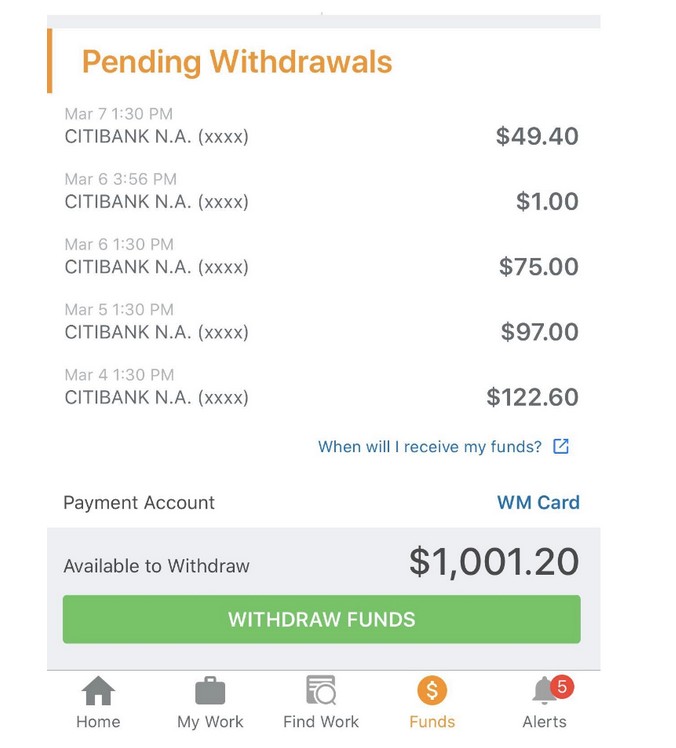

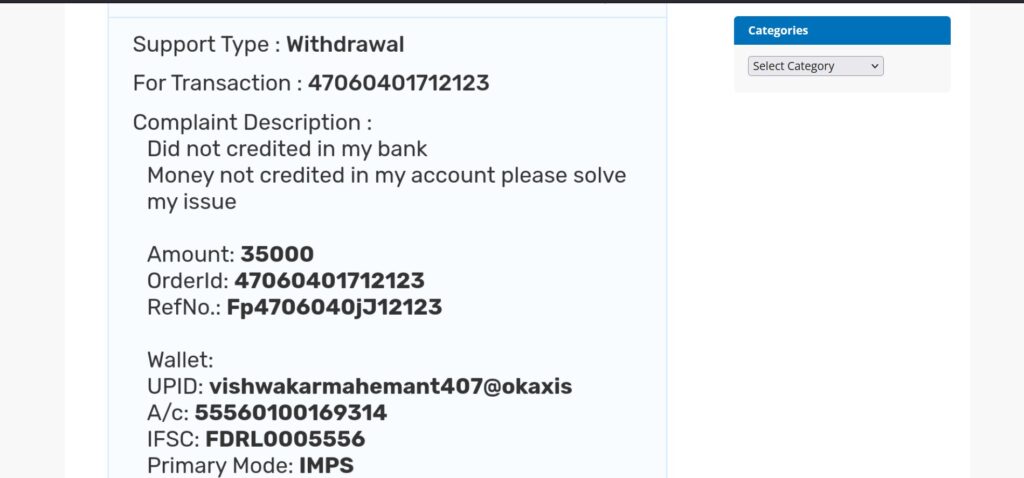

One of the most commonly reported concerns associated with the TradGrip.com scam involves withdrawals being delayed, rejected without clear explanation, or placed into extended review status. Some users claim that their withdrawal requests remain in “pending” for extensive periods, while others report that their accounts become restricted after initiating a payout, with no timeline for resolution provided.

TradGrip.com Scam: What You Need to Know

Another widespread issue described by users involves repeated demands for additional fees before withdrawals can proceed. These fees are often labelled as “taxes,” “verification charges,” or “compliance costs” and may be requested even after initial documentation has already been submitted. In many reports, users say that after paying one requested fee, another is demanded — repeatedly — with no meaningful progress toward releasing their funds.

Legitimate online brokers typically deduct any applicable fees directly from a user’s account balance or make fee structures transparent up front. Repeated external payment demands are widely regarded as a major red flag.

Concerns about regulatory transparency also surface in many user discussions. Reputable financial service providers and trading platforms operate under the supervision of recognized regulatory bodies and publish verifiable licensing information. Users researching TradGrip.com often report difficulty confirming any clear regulatory oversight or licensing credentials, which raises further concern among prospective traders.

Communication breakdowns are another frequently cited issue. While support representatives may appear responsive during the initial deposit and setup process, traders commonly report slow, unhelpful, or evasive responses once financial concerns arise, especially when related to withdrawals or account access. Some users describe conflicting guidance from different support agents, which further complicates resolution efforts.

As searches for terms like “TradGrip.com scam” continue to rise, more traders are seeking shared experiences and insight. Although isolated negative reviews do not by themselves confirm malicious intent, consistent patterns involving withdrawal obstacles, repeated fee demands, and poor communication suggest that caution is prudent.

If you believe you have been affected by TradGrip.com, taking swift action is important. The first step should be to stop making any further payments, regardless of how reasonable the platform’s explanations may appear. Preserve all evidence associated with your account, including screenshots of dashboards, transaction histories, withdrawal requests, emails, and all correspondence with account managers or support agents.

Another essential step is to secure your financial accounts. Change passwords, enable two-factor authentication where available, and monitor linked bank accounts, debit/credit cards, or digital wallets for any signs of unauthorized activity..

Recovering money from an online trading platform can be complicated but is not always impossible. The likelihood of success often depends on the payment method used, how quickly action is taken, and how complete your documentation is. In some cases, victims choose to report their experiences to law enforcement or financial regulatory authorities to document potential misconduct and trace suspicious transactions.

Online trading scams frequently employ phased strategies to build trust before restricting access to funds. Early interactions may appear smooth and transparent, allowing deposits and displaying positive account activity. However, once users attempt to withdraw larger amounts or significant portions of their capital, obstacles often arise, such as additional verification requirements, fee demands, and limitations on withdrawal access.

Communication that was previously frequent may suddenly become inconsistent, delayed, or unhelpful as financial concerns emerge. Some victims describe receiving contradictory instructions from multiple support representatives, further complicating attempts to resolve issues.

Education, verification, and thorough due diligence are essential for anyone engaging with online trading or investment platforms. Before making significant deposits, prospective users should confirm a platform’s regulatory status through official channels, review independent user feedback from multiple reputable sources, and ensure they fully understand how withdrawals and fees are handled. Platforms that guarantee high returns or pressure users to deposit more funds quickly should be approached with heightened caution.

Individuals considering or currently using TradGrip.com are strongly advised to proceed with caution. Based on repeated reports involving blocked withdrawals, repeated fee demands, inconsistent communication, and unclear regulatory transparency, the risks associated with this platform appear significant. Prospective investors seeking transparent, well-regulated alternatives should explore platforms that clearly disclose legal licensing, operational policies, and customer support procedures.

In conclusion, the rising number of TradGrip.com scam reports highlights the importance of thorough due diligence when engaging with online trading platforms. Blocked withdrawals, unexpected fee requests, communication challenges, and lack of transparent oversight are not characteristics typically associated with legitimate services. If you believe you have been affected, discontinue further payments, preserve all evidence, and seek professional guidance to explore possible recovery strategies.

Report TradGrip.com and Recover Your Funds

If you’ve fallen prey to TradGrip.com or a similar scam, taking immediate action is essential. Report the incident to AMBEK INVESTIGATION, a trusted organization committed to helping victims recover their stolen funds and hold scammers accountable