RoyalCazi.com Review

RoyalCazi.com is an online investment platform that has recently attracted attention from investors searching for reliable information about its legitimacy. Many people researching RoyalCazi.com are trying to understand whether the platform is trustworthy or whether it may pose financial risks due to reported complaints and withdrawal concerns.

Many users searching for “RoyalCazi.com review” or “is RoyalCazi.com legit” are seeking clarity after encountering difficulties or before making a financial commitment. This article examines RoyalCazi.com’s claims, user experiences, regulatory status, and overall risk profile.

This RoyalCazi.com scam review examines investor complaints, withdrawal concerns, regulatory status, and key risk factors users should understand before investing.

they presents itself as a professional investment service, claiming to offer opportunities for users to grow their funds through various financial products or strategies. While the website may appear polished at first glance, several warning signs suggest RoyalCazi.com may be a high-risk investment platform that should be approached with caution.

What Does RoyalCazi.com Claim to Offer Investors?

According to its promotional materials, they claims to provide investors with access to financial opportunities that may include trading, asset management, or automated investment solutions. The platform highlights:

- Easy account registration

- Modern investment dashboards

- Opportunities for capital growth

- Support for different investor experience levels

While these claims may sound appealing, they are not unique. Many questionable investment platforms use similar marketing language. What separates legitimate platforms from risky ones is transparency, regulation, and consistent withdrawal performance.

Transparency and Company Background

One of the most important factors investors should examine is who operates the platform.

Based on publicly available information, this platform provides limited verifiable details regarding:

- Company ownership

- Management or executive team

- Registered legal entity

- Physical office location

A lack of transparency is a significant risk factor in the investment industry. While it does not automatically confirm fraudulent activity, it increases uncertainty and investor risk.

Is RoyalCazi.com a Scam or a Legit Investment Platform?

A common question asked online is: “Is RoyalCazi.com a scam?”

Although they promotes itself as a legitimate investment platform, several issues raise concerns, including:

- Limited transparency

- Unclear regulatory status

- Investor complaints related to withdrawals

- Account restrictions reported after withdrawal attempts

Although not every user reports negative experiences, the combination of these warning signs is commonly associated with scam or high-risk investment platforms.

Investor Complaints and Reported Issues

A review of online discussions shows that users researching RoyalCazi.com reviews often report similar problems after depositing funds.

Common RoyalCazi.com complaints include:

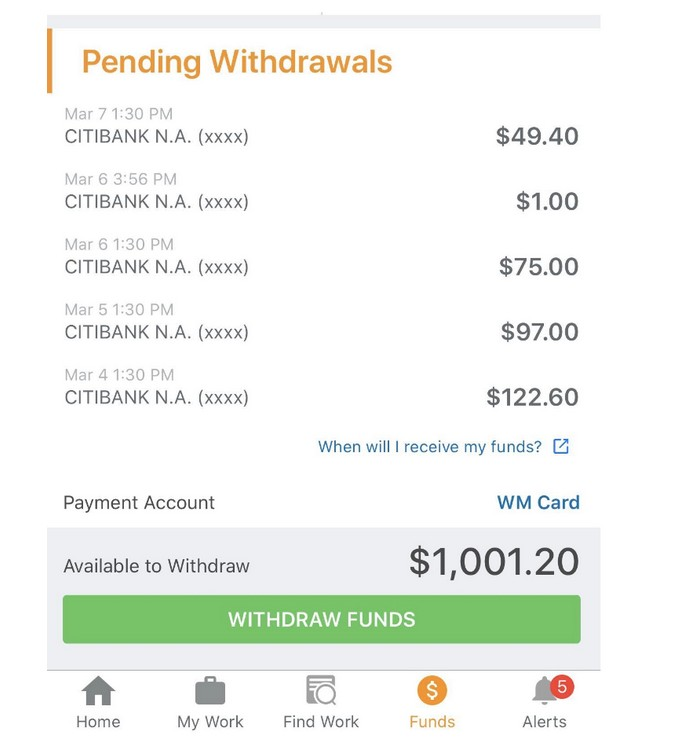

- Delayed or pending withdrawals

- Requests for additional fees before withdrawals are approved

- Sudden account restrictions

- Difficulty reaching customer support

Similar complaint patterns have been reported on other high-risk investment platforms such as

FXNovus

ARBNIX

These complaints are concerning because withdrawal problems are one of the strongest indicators of a potential investment scam.

RoyalCazi.com Withdrawal Concerns

One of the most serious issues highlighted in this RoyalCazi.com scam review involves withdrawals.

Several users claim that:

- Withdrawal requests remain pending for extended periods

- New requirements appear only after a withdrawal request is submitted

- Users are asked to pay additional “fees,” “taxes,” or “processing charges”

- Accounts are restricted after withdrawal attempts

These issues closely resemble patterns observed in cases involving

Amtefi.com

SOOLIKE.COM

Legitimate investment platforms do not require additional payments to release existing funds. Repeated withdrawal issues significantly increase the risk level of RoyalCazi.com.

Is RoyalCazi.com Regulated or Licensed?

Regulation is a critical factor when evaluating any investment platform.

At the time of writing, there is no clear public evidence that RoyalCazi.com is regulated or licensed by a recognized financial authority. Legitimate investment platforms are typically overseen by regulators such as:

- FCA (United Kingdom)

- SEC or FINRA (United States)

- ASIC (Australia)

- CySEC (European Union)

Without regulatory oversight, investors may have little or no protection if disputes arise or funds become inaccessible.

Why Regulation Matters for Investors

Regulated platforms are required to:

- Segregate client funds

- Follow strict compliance rules

- Provide transparent disclosures

- Offer dispute resolution mechanisms

The absence of regulation significantly increases investor risk, particularly when withdrawal issues occur.

How RoyalCazi.com Fits Common High-Risk Investment Patterns

Platforms that generate repeated complaints often share similar characteristics, including:

- Heavy marketing with limited transparency

- Emphasis on deposits rather than withdrawals

- Increasing friction when users request funds

- Vague or delayed explanations from support

These patterns are frequently observed in high-risk or fraudulent investment schemes.

Why Many Investors Realize Problems Too Late

Many users report that problems only become apparent when they attempt to withdraw funds. Early interactions may appear positive because:

- Dashboards show apparent profits

- Support responds quickly during deposit stages

- Restrictions appear later in the process

This delayed realization often leads to greater financial losses.

What To Do If You Have Funds on RoyalCazi.com

If you currently have funds on RoyalCazi.com or suspect potential issues, consider the following steps:

- Avoid sending additional funds

- Save all transaction records and communications

- Attempt withdrawals early

- Do not pay unexpected fees without verification

- Seek professional guidance from Ambeks investigation if access to funds becomes restricted

Investors affected by similar platforms such as

👉 Primepropx.net

have reported that early action helped reduce further losses.

How to Protect Yourself From Similar Investment Platforms

To reduce future risk:

- Verify regulation independently

- Research independent reviews and complaint trends

- Avoid guaranteed return claims

- Be cautious of pressure tactics

- Test withdrawals with small amounts

Final Verdict: Is RoyalCazi.com Safe or a Scam?

Based on investor complaints, withdrawal concerns, lack of regulatory transparency, and other identified risk factors, RoyalCazi.com shows multiple warning signs commonly associated with scam or high-risk investment platform contact Ambeks for help

Potential investors are strongly advised to exercise extreme caution and consider more transparent, regulated alternatives before committing funds.

Hi, I just found this randomly while looking for reviews online for royalcazi.com but it’s an online casino?? Well I got scammed by them and use the exact same tactics as above only difference is they claim to be a casino now.