Pulsesun.com Reviews

Pulsesun.com(Pulsesun.com) has recently attracted attention is Complaints from users about blocked withdrawals, unexplained fees, account restrictions, and communication breakdowns have led many to search for answers under terms like “Pulsesun.com scam.” This comprehensive investigation examines these reported issues, explores warning signs connected to the platform, and outlines next steps for individuals who believe they’ve been misled or defrauded.

Pulsesun.com markets itself as a cutting-edge investment platform offering access to a variety of financial markets, including cryptocurrencies, forex, indices, and commodities. The platform boasts advanced trading tools, personalized account management, and fast execution. But reports from multiple users suggest that once deposits have been made, the platform’s behavior changes significantly — especially when withdrawals are requested.

Many users report first discovering Pulsesun.com through online advertisements, social media channels, messaging apps, or referrals from other traders. These promotional messages often emphasize high returns, expert guidance, and low risk — language that can be particularly compelling to both new and seasoned investors. Such claims are common in high-risk or deceptive investment operations aiming to build trust quickly.

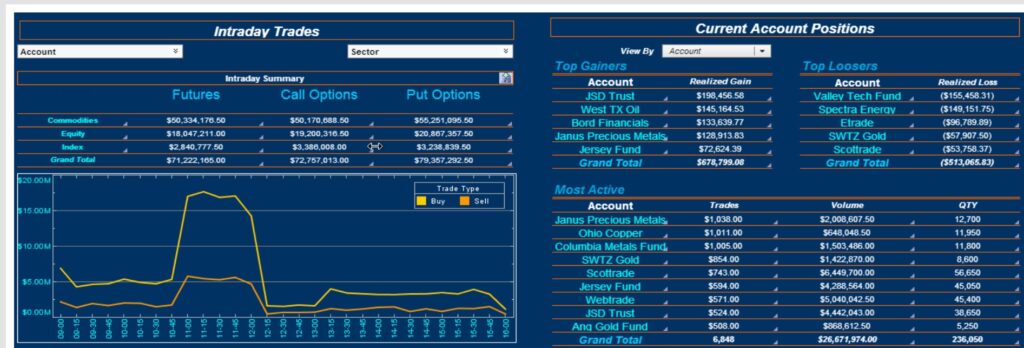

After creating an account and making an initial deposit, some individuals say they initially saw apparent profits reflected on their account dashboards. These early gains often build confidence and encourage users to add more funds. Account managers or platform representatives frequently suggest that higher deposits will unlock greater profit potential or enhanced trading features. In many of these cases, users describe the platform’s behavior as friendly and responsive at first, a tactic that fosters trust and encourages further engagement.

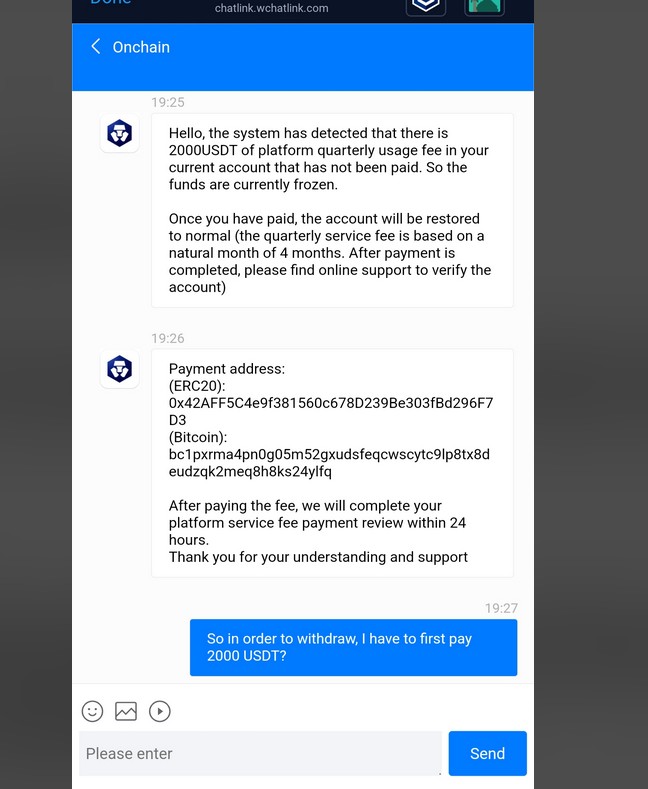

However, this initial positive experience often takes a troubling turn when a withdrawal request is submitted. One of the most frequently cited complaints related to the Pulsesun.com scam involves delayed, denied, or blocked withdrawals. Users report that once they attempt to withdraw funds — whether profits or original deposits — their account status changes to “under review” for indefinite periods, or their funds remain inaccessible without explanation. Some claim that their accounts are suddenly restricted, frozen, or flagged for review shortly after attempting to withdraw money.

Another pattern described by users involves repeated demands for additional payments in order to process withdrawals. These fees are often categorized as taxes, verification costs, compliance fees, or liquidity charges. Victims report being told that these payments are necessary to unlock their funds. After making one payment, additional fees may be requested, sometimes repeatedly, with no actual release of funds. Legitimate trading platforms typically apply all fees directly to the account balance and do not require users to transfer extra money for basic withdrawal processing.

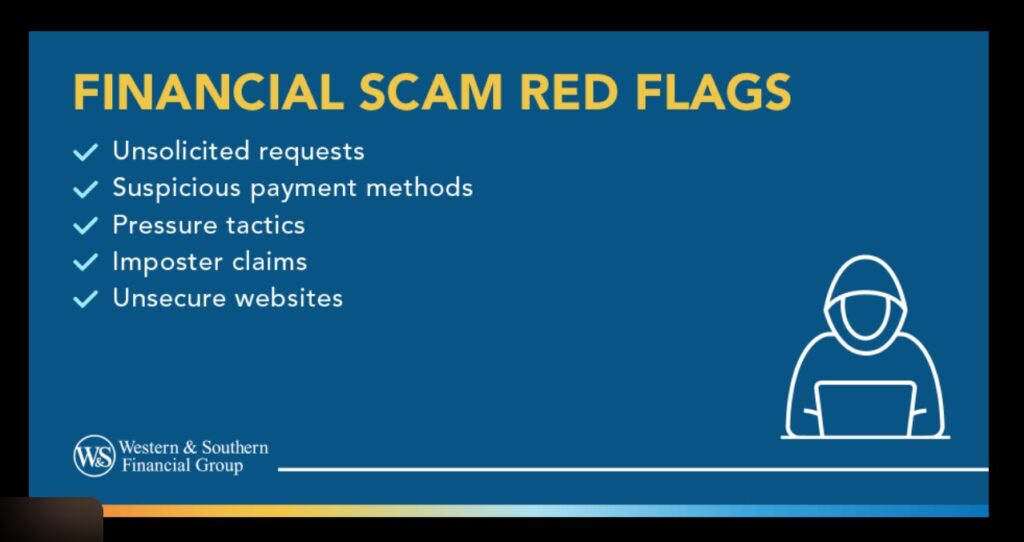

Regulatory transparency is another concern many users raise when researching Pulsesun.com. Legitimate brokers and financial service providers operate under the supervision of recognized regulatory authorities and publish clear licensing details that users can verify independently. Many trying to check the regulatory status of Pulsesun.com report difficulty finding verifiable documentation that confirms oversight by a reputable authority. The absence of clear regulatory credentials is widely considered a significant red flag when evaluating an investment platform.

Communication issues are frequently cited as well. Users have reported that once financial problems arise — especially surrounding withdrawals — the responsiveness and transparency of customer support decline sharply. Some have described vague or conflicting responses from different support representatives, while others report long delays or lack of any meaningful communication. Transparent and consistent customer communication is a cornerstone of reputable services, and its absence can exacerbate concerns and frustration for account holders.

Search interest in the term “Pulsesun.com scam” has increased as more individuals seek confirmation of their negative experiences. While a single complaint does not necessarily indicate fraudulent activity, the consistency of certain problem patterns — restricted withdrawal access, extra fee demands, and limited regulatory clarity — suggests caution is warranted. These recurring elements align with behaviors reported in connection with other investment platforms that have been identified as risky or deceptive.

If you believe you may have been affected by the Pulsesun.com scam, it’s important to take immediate action. The first step should be to stop sending any additional funds, regardless of how plausible the platform’s explanations may sound. Preserve all relevant documentation, including transaction histories, screenshots of account balances, communications with support staff, wallet addresses, bank records, and any other evidence that reflects your interactions with the platform.

Securing your personal financial accounts is also essential. Change passwords, enable two-factor authentication where possible, and monitor any linked bank or digital wallet accounts for suspicious activity. Whether you use cryptocurrency wallets, bank accounts, or other payment methods, staying vigilant about activity on those accounts is critical in ensuring your security.

Recovering money from an online investment scam can be difficult, but it is not always impossible. The likelihood of recovery depends on various factors, including the method of payment used, how quickly action is taken, whether thorough documentation is preserved, and whether authorities or institutions are willing to assist. In some cases, victims may report their experiences to law enforcement, regulatory bodies, or payment processors, which can help in tracing funds or clarifying options.

Online investment scams often operate in stages. Initially, the platform may function smoothly and allow deposits, displaying what appear to be positive returns. This creates trust and encourages users to continue engaging with the platform. Once users attempt to withdraw significant amounts, restrictions or additional requirements may appear, often without clear explanation. This staged approach is designed to extract as much money as possible before users recognize that withdrawals may not be processed.

Communication patterns may also shift as financial issues arise. Early interactions are often frequent and friendly, but once withdrawal problems begin, responses can become delayed, vague, or evasive. Some victims report contradictory information from different representatives, which only adds to the confusion and frustration.

Education and awareness are critical when evaluating any online trading or investment opportunity. Before making significant deposits, it’s essential to verify the platform’s regulatory status, read independent user reviews, and understand withdrawal and fee procedures thoroughly. Platforms that promise guaranteed returns, pressure users to act quickly, or request secrecy or urgency should be approached with caution.

Individuals considering Pulsesun.com are strongly advised to exercise extreme caution. Based on reported issues involving blocked withdrawals, repeated fee demands, inconsistent communication, and lack of clear regulatory verification, the risks associated with this platform appear significant. Potential investors should explore alternatives that are transparent, properly regulated, and supported by robust oversight and consumer protections.

In conclusion, the growing number of Pulsesun.com scam reports highlights the importance of thorough due diligence when engaging with online investment platforms. Withdrawal delays, additional payment demands, communication breakdowns, and opaque operational practices are not typical features of legitimate services. If you believe you have been affected, stop further payments, preserve all evidence, and seek reliable guidance to determine possible recovery options

Report Pulsesun.com and Recover Your Funds

Pulsesun.com Scam: What You Need to Know

If you’ve fallen prey to Pulsesun.com or a similar scam, taking immediate action is essential. Report the incident to AMBEK INVESTIGATION, a trusted organization committed to helping victims recover their stolen funds and hold scammers accountable