EZInvest.com Reviews

EZInvest.com(EZInvest.com ) platform offering easy access to markets and many investors have also encountered platforms that fail to operate transparently or in users’ best interests. One platform that has generated concern and related search queries such as “EZInvest.com scam” is EZInvest.com. This investigation dives into reported issues tied to the platform, common warning signs, how problems emerge, and what individuals can do if they believe they have been misled or lost funds.

EZInvest.com positions itself as a modern online investing and trading platform built to offer users tools for trading equities, commodities, and other financial instruments. Promotional materials for the platform often emphasize ease of use, rapid onboarding, and access to advanced trading dashboards. However, reports from multiple users suggest that once deposits are made and withdrawal attempts begin, the experience can change significantly — sometimes to the detriment of the account holder.

Many users report first discovering EZInvest.com through online ads, social media channels, or referrals from investment groups. These initial contacts often paint a picture of high returns, minimal risk, and professional account support — language that can be appealing, especially for newer investors. Unfortunately, such claims frequently appear in promotions linked to high-risk or deceptive financial operations focused primarily on accumulating deposits.

Understanding the EZInvest.com Scam

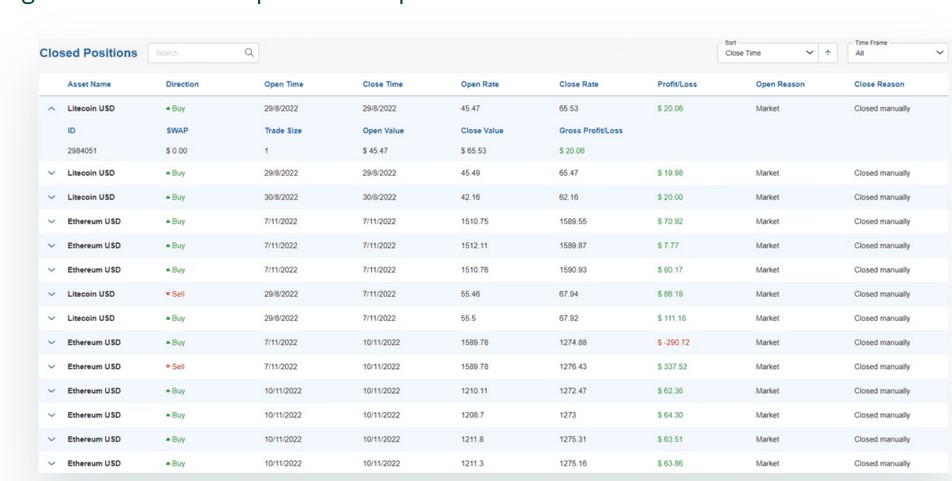

After an account is created and initial funds are deposited, some users say they observed apparent gains or profit indicators on their dashboards. These seemingly positive results can build confidence and encourage users to deposit additional funds or pursue higher account tiers, purportedly unlocking better features or greater opportunities. In several cases, users describe the early platform experience as responsive and accommodating, with account managers or support staff providing encouragement.

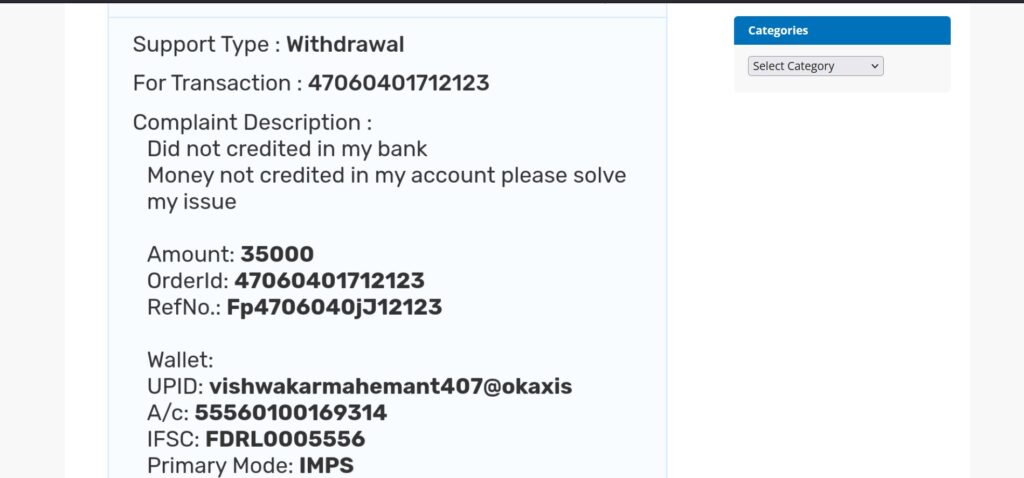

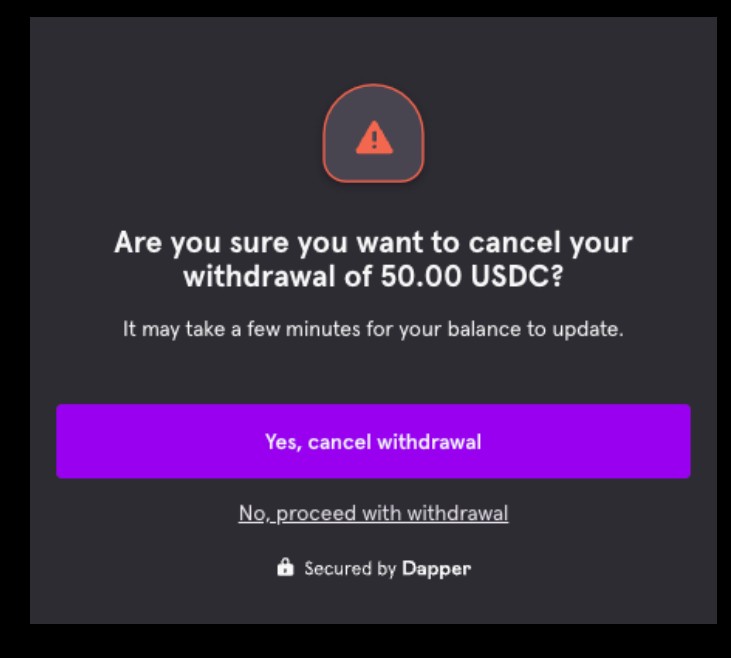

However, according to multiple user reports, a troubling pattern often emerges when users attempt to withdraw funds. Many complaints associated with the EZInvest.com scam involve withdrawal requests being delayed, declined without clear reason, or completely blocked. Users report withdrawal attempts showing as “pending” indefinitely or suddenly being restricted shortly after submitting an official request — with no transparent timetable for resolution.

Understanding the EZInvest.com Scam

In addition to withdrawal delays, another recurring concern involves demands for additional payments before funds can be released. These demands are often attributed to processing fees, compliance charges, tax liabilities, verification fees, or so-called administrative costs. Multiple users claim that after complying with one requested payment, yet another fee is immediately demanded, and this pattern repeats with no progress toward actually accessing the funds. In legitimate platforms, relevant fees are typically deducted automatically from account balances rather than requiring separate, manual transfers.

Another area where questions arise is regulatory oversight. Reputable financial services and brokers typically operate under the supervision of recognized financial authorities, and their licenses are publicly verifiable through official regulatory portals. Many individuals trying to confirm EZInvest.com’s regulatory status report difficulty locating clear, authoritative documentation showing that the platform is regulated by a recognized financial authority. The absence of transparent regulatory credentials is widely considered a significant warning sign when evaluating an investment service

Communication breakdowns also appear frequently in user complaints. While users report that initial communications with support teams or account managers may be helpful, many state that once issues arise — especially related to withdrawals — communication becomes sparse, delayed, contradictory, or unhelpful. Some users describe long waiting periods for responses, vague explanations, or responses from multiple representatives that do not align, creating confusion and frustration.

Search trends for terms like “EZInvest.com scam” and “EZInvest withdrawal issues” continue to rise as more individuals seek answers and compare experiences. While one or two negative reviews alone do not conclusively prove deceptive intentions or fraudulent behavior, the consistency of problem patterns — particularly where access to funds and additional fee demands are concerned — suggests that caution is warranted.

If you believe you have been affected by the EZInvest.com scam, the first step is to stop sending any further payments, even if the platform provides reasons that seem plausible. Preserve all relevant evidence related to your account, including screenshots of account dashboards, communication with support personnel, transaction documentation, and any correspondence that indicates terms, fees, or withdrawal requests.

Securing your financial accounts is also essential. If you have used linked bank accounts, cryptocurrency wallets, or other linked financial instruments, change passwords immediately, enable two-factor authentication where available, and monitor all associated accounts for signs of unauthorized activity. Whether you used bank transfers, credit cards, or digital currency transactions to fund your account, monitoring remains critical to protecting remaining assets.

Recovering funds from an online investment or trading platform can be difficult, but it is not always impossible. The likelihood of recovery depends on several factors such as the payment method used, the speed with which action is taken, and the amount and completeness of documentation available. In some scenarios, victims may choose to report their experiences to regulatory bodies, law enforcement agencies, or payment processors, particularly when they suspect that fraudulent behavior is involved.

Online investment scams often operate in recognizable stages. In the early phase, platforms may allow seamless deposits and occasionally display apparent gains to build user confidence. Once users attempt to withdraw larger sums or their original deposits, restrictions, unexpected requirements, or extended verification procedures often surface. This staged approach is designed to retain as much capital as possible while complicating access to funds.

Communication patterns may also shift as financial issues become apparent. Early support interactions often appear frequent, friendly, and seemingly constructive, while later communication can become inconsistent, slow, or evasive. Some users report receiving conflicting guidance from different support representatives, further hampering efforts to resolve issues.

Education and due diligence are essential when engaging with any online investment or trading service. Before making significant financial commitments, prospective users should:

- Verify the platform’s regulatory status via official regulatory authority websites

- Read independent user reviews across multiple trustworthy sources

- Understand how withdrawals and fees are structured

- Confirm whether the platform’s terms and conditions align with published regulations

Promises of guaranteed returns, pressure to act quickly, or requests for secrecy around strategies should trigger careful investigation and skepticism.

Individuals considering or currently using EZInvest.com are strongly advised to proceed with caution. Based on recurring complaints involving blocked withdrawals, repeated demands for extra payments, communication issues, and challenges in verifying credible regulatory oversight, the risks associated with this platform appear significant. Prospective investors seeking transparent and reliable alternatives are encouraged to explore services with clear regulatory credentials, documented oversight, and responsive customer support.

In conclusion, the increasing volume of EZInvest.com scam reports highlights the importance of thorough due diligence when engaging with online trading and investment platforms. Restricted access to funds, unexplained fee demands, inconsistent communication, and opaque oversight are not typical characteristics of legitimate services. If you believe you have been affected, discontinue further payments, preserve all evidence, and seek professional guidance to explore potential recovery strategies.

Report EZInvest.com and Recover Your Funds

If you’ve fallen prey to EZInvest.com or a similar scam, taking immediate action is essential. Report the incident to AMBEK INVESTIGATION, a trusted organization committed to helping victims recover their stolen funds and hold scammers accountable