Capex.com reviews

Capex.com(Capex.com) is not a all platforms that operate transparently or fairly. One platform that has drawn increasing concern from users is Capex.com. A growing number of reports suggest blocked withdrawals, unexplained fees, restricted account access, and communication problems. Many individuals affected by these issues are now searching for answers using terms like “Capex.com scam.” This comprehensive investigation explores patterns reported by users, warns of possible red flags, and outlines steps anyone who believes they may have been misled can take.

Understanding the Capex.com Scam

Capex.com presents itself as a modern online trading platform offering access to various financial markets, including forex, cryptocurrencies, stocks, and commodities. According to promotional content, the platform provides advanced trading tools, real-time market analytics, and professional account support designed to help users maximize their profits. However, multiple user reports indicate that the experience may differ significantly once funds are deposited and withdrawal requests are made.

Many users say they first encountered Capex.com through targeted advertisements, social media promotions, or referrals within investment groups online. These promotional messages often feature claims of high returns, sophisticated trading systems, and minimal risk — language that can be particularly appealing to both new and experienced investors. Unfortunately, such messaging is commonly used in high-risk or deceptive investment schemes that emphasize attracting deposits before facilitating legitimate trading outcomes.

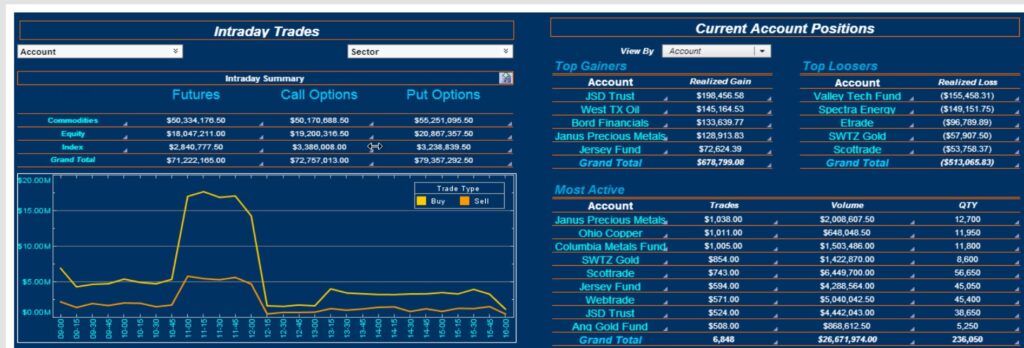

After creating an account and making an initial deposit, some users report seeing apparent gains reflected in their account dashboards. These displayed increases can create a false sense of legitimacy, encouraging users to deposit additional funds or upgrade their account tier to access more features or supposedly better returns. Many users describe early interactions with account managers or support representatives as friendly and responsive, which builds confidence and prompts further engagement.

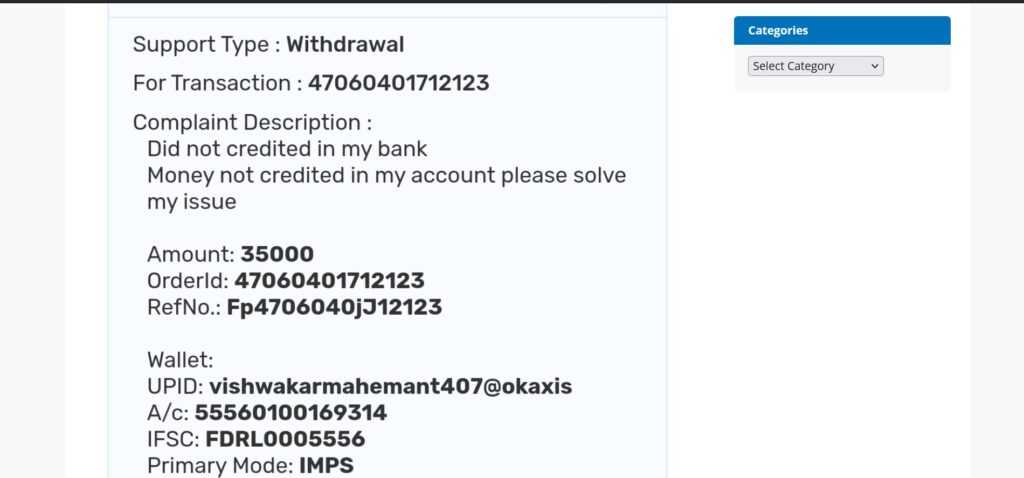

For some users, however, this early positive experience changes once they attempt to withdraw funds from the account. One of the most frequently reported issues linked to the Capex.com scam involves delays, restrictions, or outright blocks on withdrawal requests. Users claim that once they try to withdraw either their profits or their initial investment, their withdrawal status remains in a pending state for extended periods without clear explanation. In other cases, accounts have been restricted or frozen when users attempt to access their funds.

Another disconcerting pattern reported by victims involves repeated demands for additional payments before processing withdrawals. These payment requests are often labeled as taxes, verification fees, compliance charges, or liquidity fees. In many user reports, after one requested fee is paid, another is immediately demanded, and another after that. Legitimate trading platforms typically apply any necessary fees directly to the account balance and do not require users to send additional payments outside of the normal withdrawal process.

Regulatory transparency represents another area of concern among individuals attempting to verify Capex.com’s legitimacy. Reputable brokers and investment services operate under the supervision of recognized financial regulators, and their licensing details are publicly verifiable through official channels. Many users attempting to confirm Capex.com’s regulatory status report difficulty locating any credible licensing or regulatory oversight information. The absence of transparent, verifiable regulatory credentials is widely regarded as a serious red flag when evaluating an online financial platform.

Communication breakdowns are also commonly mentioned in user complaints. While the platform may initially appear to provide responsive and helpful customer support, many users state that once issues arise — particularly regarding withdrawal problems — the quality and frequency of communication decline sharply. Some individuals report vague or conflicting responses from different support representatives, long delays before a reply, or no response at all. Consistent, transparent communication is a hallmark of reputable services, and its absence can add to the frustration and confusion faced by users.

Search data shows a rise in searches for “Capex.com scam,” suggesting that an increasing number of individuals are encountering similar issues and seeking answers. Although a handful of negative reports does not necessarily confirm fraudulent behavior, the consistency of specific themes — such as blocked withdrawals, repeated fee requests, and poor communication — suggests that caution is warranted.

If you believe you have been affected by the Capex.com scam, immediate action is crucial. The first step is to stop sending any additional payments — no matter how reasonable the platform’s explanations may seem. Preserving all relevant documentation is essential; users should save screenshots of account balances, email communications, payment receipts, and any chat logs with support or account managers. These records may prove invaluable if you pursue recovery options or need to demonstrate the sequence of events.

Securing your personal financial accounts should be another priority. Change passwords, enable two-factor authentication where possible, and monitor any associated bank accounts or digital wallets for unusual activity. Whether your funds were transmitted through bank transfers, credit cards, or cryptocurrency transactions, maintaining vigilance is essential to protecting remaining assets and minimizing further risk.

Recovering funds from an online investment scam can be challenging, but it is not necessarily impossible. The prospects for recovery depend on multiple factors, including how payments were made, how quickly action is taken, and the completeness of documentation. Some victims may choose to report their experiences to law enforcement agencies, regulatory bodies, or payment processors, which can sometimes help trace transactions or identify patterns of suspicious activity.

Online investment scams often follow a staged sequence designed to build trust before restricting access to funds. Initially, these platforms may operate smoothly, allowing users to make deposits and sometimes display apparent gains. Once users try to withdraw larger sums or significant portions of their deposit, restrictions, additional requirements, or extended verification requests often appear. These tactics are designed to retain as much capital as possible before users recognize that withdrawals may not be honored.

Communication patterns may also change as financial issues arise. Interactions with support staff early in the process may be frequent, friendly, and seemingly helpful, while later responses may become delayed, vague, or evasive. Some victims report that different representatives provide inconsistent information or conflicting instructions, making it increasingly difficult to navigate resolution strategies.

Education and diligence remain vital for anyone participating in online investment or trading activities. Before making significant deposits, prospective users should verify a platform’s regulatory status via official channels, read independent user feedback from multiple credible sources, and fully understand how withdrawals and fees are handled. Platforms that promise guaranteed high returns, pressure users to act quickly, or require secrecy or urgency should be approached with caution and deeper investigation.

Individuals considering or currently using Capex.com are strongly advised to proceed with caution. Based on repeated reports involving restricted withdrawals, repeated fee demands, inconsistent communication, and difficulty verifying credible regulatory oversight, the risks associated with this platform appear significant. Prospective investors seeking transparent and legitimate alternatives are encouraged to explore platforms with proven regulation, clear operational policies, and responsive customer support practices.

In conclusion, the growing number of Capex.com scam reports emphasizes the need for thorough due diligence when engaging with online investment platforms. Restricted withdrawals, unexplained fee requests, communication breakdowns, and lack of transparent regulatory verification are not typical characteristics of trustworthy services. If you believe you have been affected, discontinue further payments, preserve all evidence, and seek reliable guidance to assess possible recovery options.

Report Capex.com and Recover Your Funds

If you’ve fallen prey to Capex.com or a similar scam, taking immediate action is essential. Report the incident to AMBEK INVESTIGATION, a trusted organization committed to helping victims recover their stolen funds and hold scammers accountable