Dexswap.com Scam

Dexswap.com(Dexswap.com)is a notable risks for investors worldwide. Among these platforms that have recently gained attention — and concern — is Dexswap.com. A growing number of users are reporting issues such as blocked withdrawals, unexpected fee demands, account restrictions, and communication breakdowns. Because of this, many individuals are now searching for answers using terms like “Dexswap.com scam.” This comprehensive investigation examines the experiences users report, highlights potential warning signs, and suggests steps that anyone who believes they’ve been misled can take to protect themselves.

Dexswap.com promotes itself as a modern digital trading platform designed to give users access to cryptocurrency trading and decentralized finance (DeFi) tools. According to the platform’s promotional content, users can benefit from advanced trading features, real-time market data, and smart contract integrations. However, multiple reports from users suggest that the experience may differ significantly once deposits are made and withdrawals are requested.

Understanding the Dexswap.com Scam

Many users report that they were first introduced to Dexswap.com via social media advertisements, online promotional campaigns, or referrals within investment groups. These advertisements often feature bold claims of fast profits, cutting-edge technology, and minimal risk — language that can be especially attractive, particularly to newer investors. Unfortunately, such messaging is frequently associated with high-risk or deceptive investment schemes that focus more on generating deposits than on delivering real trading performance.

After creating an account and depositing funds, some users have reported seeing apparent gains reflected in their account dashboards. These gains, which may appear quickly and without clear explanation, can create false confidence and prompt users to deposit larger sums or upgrade their accounts for access to more tools or better performance. In multiple reported cases, assigned account managers encouraged users to increase their investments, often without full disclosure of risk or withdrawal conditions.

However — according to several user accounts — the situation takes a troubling turn once withdrawal requests are submitted. One of the most commonly cited problems associated with the Dexswap.com scam involves delayed, denied, or blocked withdrawals. Users report that once they attempt to withdraw their funds — whether profits or original deposits — their withdrawal status remains pending for extended periods without clear explanation, or their accounts become restricted or frozen shortly after making the request.

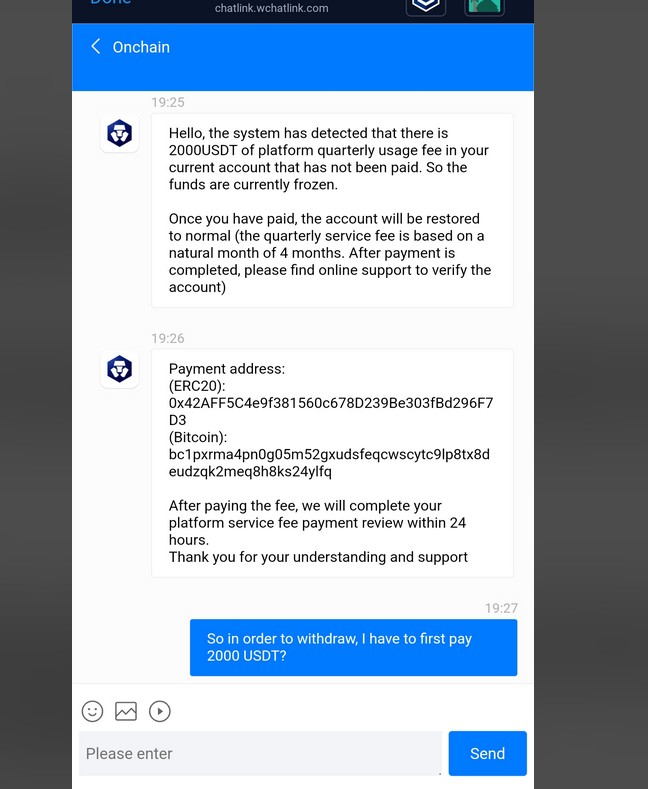

Another concerning pattern reported by victims involves repeated demands for additional payments before withdrawals can be processed. These payments are often attributed to taxes, processing fees, verification costs, or liquidity charges. Several users state that after paying one requested fee, another is immediately demanded, and then another, with little to no progress toward releasing the funds. Legitimate trading platforms typically deduct any required fees directly from the account balance and do not require users to send additional payments before processing a withdrawal.

Regulatory transparency is another common concern among individuals trying to verify Dexswap.com’s legitimacy. Reputable brokers and trading platforms operate under the supervision of recognized regulatory authorities and provide verifiable licensing information that users can independently confirm. However, many users attempting to check Dexswap.com’s regulatory status report difficulty locating any legitimate licensing or oversight information from recognized authorities. The absence of transparent regulatory credentials is widely considered a strong warning sign when evaluating online financial services.

Communication breakdowns are also frequently noted in user reports. Many users say that initial communications with customer support were friendly and responsive, especially early in the account lifecycle, but that responsiveness often declines when financial issues such as withdrawal problems arise. Some users describe vague or conflicting responses from support representatives, long delays before any reply, or no response at all. Transparent communication is a characteristic of reputable services, and its absence can leave users confused and frustrated.

Search interest in the keyword “Dexswap.com scam” has been growing as more individuals seek clarity about shared experiences. While a handful of negative reviews does not necessarily confirm fraudulent behavior, the consistency of specific patterns — particularly withdrawal issues and repeated fee demands — raises legitimate concerns for investors and prospective users alike.

If you believe you have been impacted by the Dexswap.com scam, acting quickly is crucial. The first and most important step should be to stop sending additional funds, regardless of how plausible or urgent a platform’s explanation may seem. Preserving all relevant documentation is essential; users should save screenshots of account balances, email communications, transaction receipts, and any chat logs with support or account representatives. These records may be critical if you pursue recovery options or file a report with authorities.

Securing your financial accounts is another key step. Change passwords, enable two-factor authentication where available, and closely monitor any linked bank accounts or digital wallets for unusual or unauthorized activity. Whether your connections involve traditional bank accounts, credit cards, or cryptocurrency wallets, staying vigilant about activity is essential to protecting any remaining assets.

Recovering funds after an online investment scam can be challenging, but it is not always impossible. The potential for recovery depends on multiple factors, including the method of payment used, how quickly action is taken, and the completeness of available documentation. In some cases, victims may seek assistance by reporting their experiences to law enforcement, regulatory bodies, or payment processors, which may help in tracing transactions or identifying patterns of fraudulent activity.

Many online investment scams follow a staged process to build trust before restricting access to funds. Initially, the platform may operate as expected, allowing users to make deposits and sometimes showing apparent gains. Once users attempt to withdraw significant amounts or access their deposits, restrictions, additional requirements, and unexplained delays often appear. This approach is designed to retain as much capital as possible before users recognize that genuine withdrawals may not occur.

Communication practices may also shift as financial concerns arise. Early interactions with support staff may be frequent and helpful, but once withdrawal issues occur, responses may become delayed, vague, or inconsistent. Some victims report receiving contradictory explanations or instructions from different representatives, compounding confusion and emotional distress.

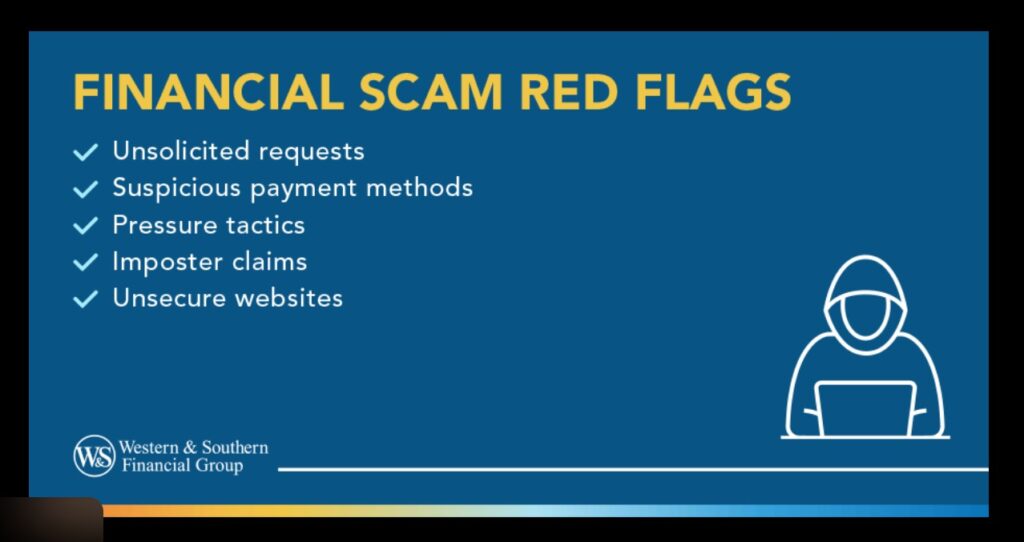

Education and awareness remain essential for anyone engaging in online trading or investment activities. Before making significant deposits, potential users should verify a platform’s regulatory status through official channels, read independent user reviews from multiple reputable sources, and fully understand how withdrawals and fees are handled. Promises of guaranteed high returns, pressure to act quickly, or requests for secrecy around strategies should all raise red flags and prompt deeper investigation.

Individuals considering or currently using Dexswap.com are strongly advised to proceed with caution. Based on repeated reports involving blocked withdrawals, multiple payment demands, declining communication transparency, and difficulty verifying verifiable regulatory oversight, the risks associated with this platform appear significant. Prospective investors seeking transparent, properly regulated alternatives should examine options that disclose clear licensing, fee structures, and responsive customer support procedures.

In conclusion, the rising number of Dexswap.com scam reports emphasizes the need for thorough due diligence when engaging with online investment platforms. Restrictive withdrawal practices, unexplained fee requests, communication breakdowns, and lack of transparent regulatory verification are not typical of legitimate services. If you believe you have been affected, discontinue further payments, preserve all evidence, and seek trusted guidance to assess possible recovery options.

Report Dexswap.com and Recover Your Funds

If you’ve fallen prey to Dexswap.com or a similar scam, taking immediate action is essential. Report the incident to AMBEK INVESTIGATION, a trusted organization committed to helping victims recover their stolen funds and hold scammers accountable.